Credit card debt is possibly the worst, most insidious debt trap in which to be caught.

Not only is your balance attracting extortion level interest, whatever you bought and are still paying for has probably already been used, eaten, or thrown away… Months ago!

Additionally, paying it off can be a situation of one step forward and two steps back.

Unless you do two things:

- Pay more than the credit card company’s recommended minimum payment and;

- Stop adding to the balance.

Table of Contents

It’s Not Just YOU…

If you’re struggling with credit card debt you’re not alone, Debt Relief Australia spokesperson Deborah Southon says, “More than 70,000 Australians visit the debt resolution site each year seeking help.” The truly frightening aspect of this statistic is that, generally, people don’t seek help with debt until they finally admit they’re drowning in it. That’s over 1300 families and individuals, every week, finally admitting that they are in trouble.

Apparently, one of Debt Relief Australia’s clients owed $450,000 (10 different credit cards) and earned a salary of only $40,000 per annum. Paying off one credit card with another was rapidly increasing the debt and severely affecting her mental and physical well-being.

The above is an extreme case, but it serves to highlight how easily you can compound your debt with credit cards and how long it can take some folk before they admit they’re in over their head and need help.

So, how best to tackle your debt?

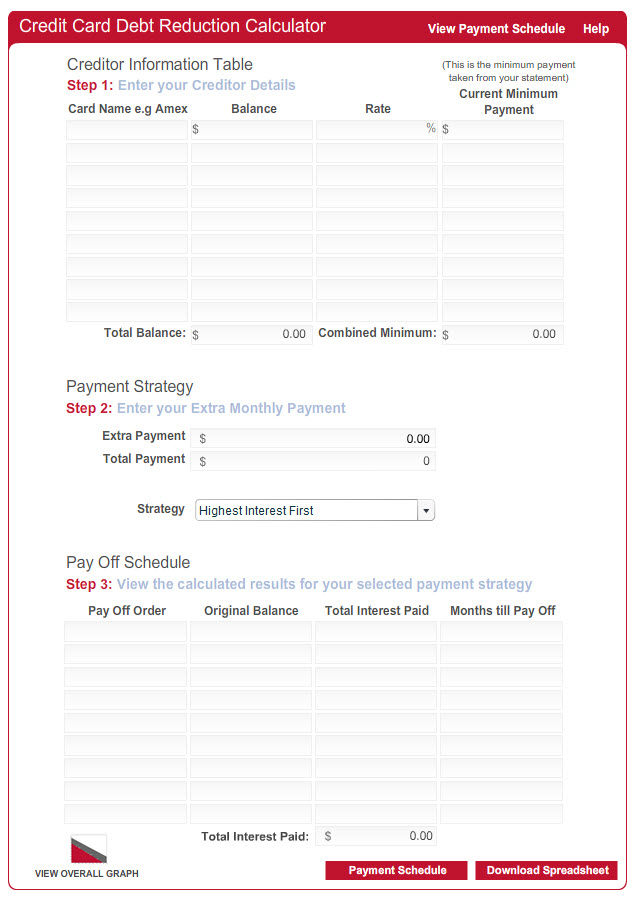

There are two schools of thought on this subject: pay off the smallest debt first (snowball method) so you can feel the positive feedback of accomplishment or; pay off the debt with the highest interest rate (avalanche method) because ultimately, this debt will cost you more.

The option you choose is up to you. The most important thing is making the commitment to act and then following through.

Related Posts:

- The Top 5 Online Debt Reduction Calculators

- The Secret to Paying Off Debt

- 5 Tips for a Successful Spending Freeze

- Stop Impulse Spending with this Neat Trick

If you’re not sure where to start, use a debt repayment calculator to test different repayment scenarios. Whatever plan you decide on, make sure you put it into action.

What else can you do if your credit card debt is out of control?

Debt Consolidation

You could consider consolidating your debt. Before consolidating your debt, get some professional advice.

It can be more overwhelming, and riskier, to have all your debt ‘eggs’ in the one basket. Plus, consolidating your debt doesn’t give you the opportunity to address the behaviour that caused you to accumulate the debt in the first place.

Balance Transfers

Lots of credit card companies offer 0% interest on balance transfers.

Check the fine print, though. Often the 0% interest is only for a short time.

Remember, the credit card companies make these offers in order to get your business, not to help you pay down your debt.

Roll Up Your Payments

Once you’ve paid off the first card, add those payments to the payments for the next card on your list. This is also known as the ‘snowball method‘ because as your cards (or other debts) are paid, your payment amount will begin to snowball, accelerating your pay down rate.

What should you do when you pay off a credit card?

Close the Credit Card Account

This might seem obvious, but… if you have multiple cards, and you’ve paid one of them off – close the account.

Unless you’re as disciplined as a monk, you only need one card, for emergencies.

You’ve paid off your credit card debt. What’s next?

The first thing you should do is congratulate yourself! The next thing you should do is make a commitment to your new found freedom from credit card debt and create a budget you can stick to.

Build your Savings

Once you’re out of debt, start building your savings using all or most of the money you previously dedicated to debt repayment.

Aim to accumulate $1000 in a savings account as a buffer should you have an unexpected bill – something you previously would have pulled out the credit card for.

Then, set a target of three months living expenses for your Emergency Fund and start putting that money into a separate savings account.

Have you tackled credit card debt and lived to tell the tale? Share your story in the comments and we’ll all benefit from your experience.