Budgeting is easy once you have the right tools, but not everyone can afford an accountant.

The good news is that you don’t need an accountant for your day-to-day expenses. All you need is a tick box list or a basic spreadsheet to help you visualize and understand your finances.

Having a budgeting system can help you stay on top of your money and see exactly where it’s going.

To help everyone trying to manage their finances, we have gathered 20 free printable templates, so no matter your style and no matter your budget, you can find something to help you.

We will explain how to use them and what they are good for. Go through the list and figure out which is best for you.

Table of Contents

How To Choose The Right Budget Template For You

If we gave you one budget and expected it to work for you without any changes, then we wouldn’t be doing a good job. There are multiple ways to budget, each great for different lifestyles. That’s why we suggest going through all 20 of our suggestions before you stick to one.

One of the only universal great ideas in budgeting is seeing your monthly expenses easily. You shouldn’t have to rifle through paperwork after paperwork to see how your budgeting is going – clarity is critical.

A good budget should factor in all of your essential expenses like rent and utilities, along with your savings goals (if any) and room for fun.

When you are looking through these templates, search for something that seems effortless and allows you to live your life without much restriction.

How Do You Use A Printed Budget Template

The first concept of budgeting is being truthful. There is no point in lying to yourself about how much money you take home or how much takeout you have. Your finances won’t round the figures to the nicest number, so neither should you.

To start your budget, input all your income for the month (or week, if that’s easier). Then you add in all of your bills, subscriptions, and necessary payments for the month (or week if that’s the format you have chosen).

Lastly, you minus your bills from your income – this shows you your “surplus” money. Ideally, this number shouldn’t be negative.

If the number is negative, it means you’re running yourself into debt. To stop this, you should cancel any non-important payments (like the gym or a wine club). Keep doing this until your “surplus” is positive or 0.

If you cannot get rid of any more bills, then you need to consider changing suppliers or looking for something cheaper. Another option is to increase your income through a side hustle or another job.

When it comes to printed budget templates, you need to print off the sheet every month and fill in the details again. This can help you focus on your positive financial changes (like paying off a credit card) or notice when a bill has changed.

20 Free Printable Budget Templates

Now for your free templates!

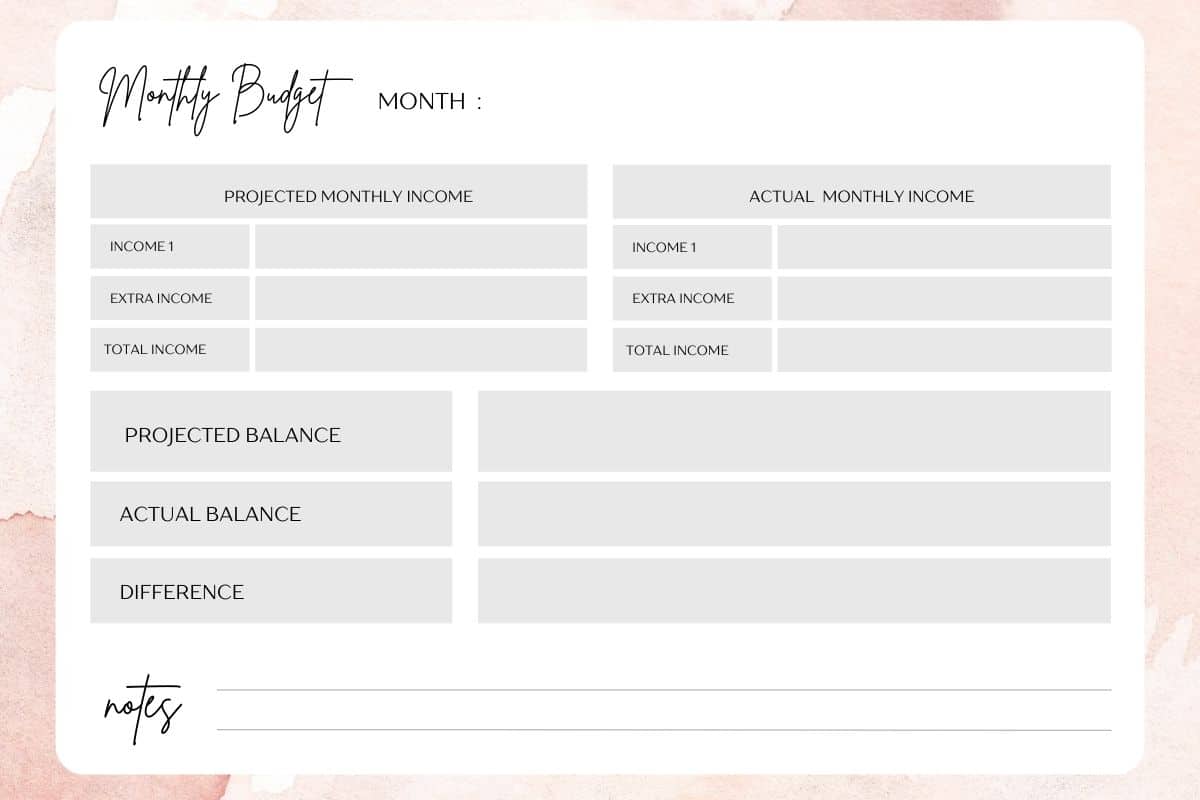

1. A Simple Budget Template With Room For Extra Expenses

Printable Crush currently has four types of budget planners; one is for business, another for families, the third can be personalized, and the fourth is free.

The free template is extremely easy to use, opting for simple descriptions and simple math. They have a column for “budget” and another for your “spent,” that way, you can quickly see how much you have accounted for and how much you actually spent.

Everything is easily laid out to make the process easier. They have a colorful version and a green version.

2. Personalizable And Simple Budget Template

If your budget is a little unusual, you should use Savvy Budget Boss’s free templates. It is editable, so you can customize your template to better suit your life, or you can take their suggested inputs.

For example, there is a health section in the suggested inputs, but your health finances might not need a whole part dedicated to it. Instead, you can change this to “kids” instead.

The idea is very simple, as you write in the number of expenses and the cost. Then you add up the totals and find your remaining balance.

The downside is you have to sign in to get the template.

3. Budget Template For A College Student

College students are in a strange part of their life. They are considered adults and can live their lives freely, but they haven’t had the chance to understand the adult world yet.

To help these wandering souls, College Life Made Easy has created a budget in which every possible section is filled in and waiting.

There are the typical sections such as housing, monthly bills (like phone bills), and groceries. But there is a school section and a debt section too. You can find typical college expenses in this area, like textbooks, internet bills, and tuition fees.

Although there is a blank version available, we suggest getting the pre-filled version first. Once you get the hang of budgeting for adult life, then swap to a more personalized sheet.

4. Less Fluffy More Formal

If you’re not a fan of the bright and colorful budget templates and need something a little more serious to help you stay on track, then use Gathering Dream’s version.

Everything is laid out for you, from transport to pet food to property taxes. Unlike the other templates on our list so far, Gathering Dreams is the only one to include investment percentages and taxations.

Unfortunately, they don’t include the equations, which means you should already have an idea of how these increases and decreases affect your budget.

5. Fixed And Variable Monthly Bills

Mom Managing Chaos allows you to add multiple incomes to the template and to separate your bills into fixed and variable expenses. This is an excellent template for families or households that receive multiple wages, and it allows you to change with your monthly expectations.

Variable monthly bills could include babysitters, dog walkers, or anything that only pops up once in a while. While the fixed monthly bills include items that don’t change, such as rent.

There is also a third section called “discretionary spending,” which simply means small spending like coffee or the hairdressers.

6. Big Enough For A Binder – Meal Plans Included

The templates above have all been small enough to either fit on one page or two. But if you want a less condensed version, then you should try Thirty Handmade Days’ binder collection.

In it, you will find a weekly ledger to record your everyday expenses and deposits, a monthly catalog for common bills, savings pages, debts pages, your month in a glance, and your year in a glance.

There are also pages for your meal planning and your grocery list! This might seem like a separate concept, but meals are one of the biggest expenses in our month. Planning your meals can help against food waste or random takeouts, which in turn saves you money.

You can download the pages here for free.

7. Big Enough For A Binder – Rainy Day Savings

Money Minded Mom also has a binder-sized package that you can download for free. Unfortunately, you do have to sign in to get the template, but no money is exchanged.

The biggest difference between Thirty Handmade Day and Money Minded Mom is the additional help section. Money Minded Mom helps you figure out your saving percentages for those rainy days and gives you visual cues to see your money pot grow.

8. Big Enough For A Binder – Color Collection

Blooming Homestead is another free template big enough to fit a binder. However, this collection is designed with aesthetics in mind. If you consider coin-counting a calming and mindful activity, you should have a collection to match.

They have three options for you to choose from.

9. Big Enough For A Binder – Payment Dates Included

If you want your budget template to hold more information than the financial figures, then The Frugal Foot Doc has the binder collection for you.

They have the standard income and expense format, but they also have a bill checklist to help you keep track of what you’ve paid in a payment calendar.

You can put in what payments are needed by when to help you keep on track!

10. Big Enough For A Binder – Family Addition

If these binder collections sound great for you, but you need more room for the extra income and additional expenses, then pick Clean And Scentsible’s version. They give you room for separate and joint payments to help you separate any unconnected bills.

There are also multiple comment sections for any notes you need to share with your partner.

11. Big Enough For A Binder – Financial Goals

Just A Girl And Her Blog has created a budget binder template too. Her template is based on your financial goals and the timeframes you hope to accomplish them by. Need to save money for a wedding or pay off your debts? This binder can help you achieve that!

12. Zero Based Budget Template

A zero-based budget is a system where all of your money is allocated somewhere. At the end of the month, you should have no money left.

The idea is that any funds not assigned to a specific location are then sent to your savings account. It is removed from your casual spending account so that you are aware of exactly how much money is available when you need to use your savings.

Moritz Fine Designs has created a simple template for you to print off for free. The design is simple, and so is the concept!

13. Math Made Easy

If you want to get into budgeting but know that you’ll forget the math behind the method, then use The Savvy Couple’s template.

They include simple math for each step to help you navigate the world of budgeting.

14. Family Budgeting

If you are budgeting for a family, then there is a lot you need to remember – childcare, health insurance, entertainment, and so much more. You have to be financially prepared for yourself and another person.

To help you stay on top, A Mom’s Take has created a free budgeting worksheet for parents in mind.

15. Clear And Simple In Three Colors

If you just need the stripped-down version of a budget template, then try Bobbi Printable’s version. There aren’t pages and pages of information to fill in, and you don’t need to separate all of your billing information if you don’t want to.

The format is clear, so your head can be too.

16. Basic Version For Those Already In The Know

If you already know what you are doing with your finances and just want a simple template to fill in the details, try Scattered Squirrels’ free template. The one page has enough space for four months of budgeting.

The cut-down version allows you to see what you’re doing without needing a binder.

17. Colorful And Goal Orientated

If you have financial goals in mind, you can record them and their growth using A Spectacle Owl’s template. The top information is dedicated to a clear and easy-to-read savings guide with a progress monitor as well!

18. Simple And Large

If all these small boxes and tiny writing is putting you off, try A Cultivated Nest’s large font budget template. Everything has been made simple, leaving the fuss out of your finances.

19. All The Detail But On One Page

If you would like the details found in the binder packs, but would rather everything be on one page, try My Frugal Home’s budget template. All the details you could possibly need are on this sheet!

20. Daily Expense Tracker

If you simply need help managing your daily spending, On Planner’s tracker is the perfect fit. They ask you to fill in the date, how much you spent, the type of spending that was involved, and how you spent the money (cash, credit, debit, etc.).

This can help you figure out how much money you have left on your credit limit and where your free-spending cash has gone!

Want To Go Digital? – Budgeting Apps And Spreadsheets

If the idea of a budget template sounds excellent, but you don’t like the idea of using paper and filing it away, then try going digital.

There are a lot of free digital budgeting apps or spreadsheets that do the same thing as these printable paper versions, but they do the math for you and allow you to store the data without taking up physical room.

1. Excel Spreadsheets – Spreadsheet

Excel isn’t a free application for everyone, but some computers have Microsoft apps pre-installed, and many companies pay for their workers to use the software. This is why we are considering it a free or low-budget option for most people.

In Excel, you can find a free budgeting template pre-made and ready for you. The equations are already set in, and all you have to do is fill in the numbers.

2. Google Sheets – Spreadsheet

Google Sheets is free for everyone; the only caveat is that you need a google account to use it. They also offer a template with all the formulas pre-made, allowing you to simply add in the data.

If you are proficient in Google Sheets, you can also add in your own equations, building from the basic information they have prepared for you. The same goes for Excel.

3. Fudget – App

Fudget is designed for mobile devices and uses a simple addition and subtraction system to manage your money. It is an excellent tool for daily spending, as you can add your grocery shopping without having to pull out a sheet of paper or remember the numbers. You can simply type the numbers into your phone as you pay the bill.

4. EveryDollar – App

EveryDollar focuses on zero-based budgeting. It’s another simple app (although not as simple as Fudget), which helps you see where your money is going.

Being a zero-based budget means that every dollar you don’t spend at the end of the money is highlighted to you. It then suggests saving the funds and starting from zero again!

Summary

Getting your budget started has never been easier. If you want a free printable paper copy, we have 20 templates for you to print off, but there are free options available if you prefer a digital version.

Take control of your finances by choosing one of these simple templates!