How to Save a Little and Live a Lot

It can be tough to save money when you’re already on a tight budget. The more you squeeze your budget, the more squeezed you feel.

The truth is, everyone needs to save money. Even if it’s just a small amount each week.

It does add up.

When money is tight, saving is usually the first ‘luxury’ to go.

In uncertain times like these finding ways of saving even a little bit can make a huge difference to your overall sense of well-being and security. So, if you’ve been thinking saving money is the first thing to go, think again. It’s time to change your mindset so you can save a little and still live a lot.

Here goes…

7 Smart tips for saving money… Even if money is tight

Table of Contents

1. Check your budget

The absolute first thing you must do if you’re serious about saving, even just a little bit, is to see how much you have coming into your budget and how much you have going out. You might be surprised by the numbers – hopefully in a good way.

Don’t have a budget? Create one now.

Creating a budget isn’t rocket science. If you have Microsoft Exell you’ll find it has a template you can use to get started but putting a budget together is as simple as grabbing a piece of paper and drawing a line down the middle. Every dollar that comes in to your household goes on one side and ever dollar that goes out, goes on the other. Total the columns and see which number is bigger.

Hopefully, it’s the money coming in.

If not, you’ll need to do some fine-tuning.

2. Cut the luxuries

You don’t necessarily need to cut them all but, if you need to create a surplus in your budget, you’re going to need to cut something. Or earn more… But, we’ll get to that in a minute.

So, check out your spending habits, do you:

- Grab a takeaway coffee on the way to work each day? Brew your own at home and use a travel cup. This could save you around $4.00 per day ($80 per month). Make it a Friday morning treat instead.

- Buy lunch every day? The cheapest sandwich near my office was about $6.00. Take your own lunch to work and save anywhere over $120 per month.

- Relax in the evening with a glass of wine? Save it for celebrating the end of the week instead of the end of the day. Better for your health and better for your budget. An approximate saving of about $100 per month.

- Pay for a gym membership? Check out youtube for free fitness videos instead. You’ll find everything from aerobics to zumba.

- Buy something new for your home or wardrobe every week? Retail therapy can cost you a fortune and yet it never resolves anything. If you think this might be you, stay out of the shopping centres.

Remember, you don’t need to cut these things out completely, the whole idea is to still enjoy life, so reduce your indulgences rather than give them up completely. Unless, of course, you currently live beyond your means. Then, I’m sorry, but the luxuries will have to go. For the moment.

Don’t indulge in any luxuries? You’d definitely benefit from tracking your spending to see exactly where your money goes and see if you can cut back on any of the basics like groceries, utilities, and transport.

Related Posts:

- 8 Easy Ways to Save Money When Shopping for Clothes

- Top 5 Money Stresses and How to Manage Them

- 15 Frugal Living Tips – To Get You Started

- 11 Excuses to Stop Making So You Can Start Saving

- Five Savings Goals that will Change Your Life

- How to Fix Your Budget When it isn’t Working

- 21 Painless Ways to Make Extra Money

3. Start a savings jar

Even adults benefit from owning a piggy bank.

I use a jar to collect loose change and the small coins I acquire by selling plants at my garden gate. Once it’s full, I take it to the bank and deposit the contents into my bank account via their nifty coin counting machine. Quick and painless, and often feels like free money.

Removing the coins from your pocket is easy enough but taking them out of your wallet can take a bit of a change to your mindset. The easiest way to start is to empty the coins out of your wallet on payday. Once you get the hang of it, you’ll be able to do it more often without feeling like you’re depriving yourself.

If money is really tight, pick one denomination of coin and put that in your savings jar.

Once you get into the swing of things, the coins will accumulate quickly.

4. Pick up the phone

And, see if you can get a better deal from your utility providers, insurance companies, and telephone provider.

You’d be surprised how much you can save and it really is a case of if you don’t ask, you won’t get. So, ask.

It’s in these companies’ best interest to keep you has a customer so they’ll usually find savings somewhere for you. If not, ring their competitors to see what they’ll offer you to switch.

Whatever savings you can find, update your budget and make sure that money goes into savings.

5. Check your bank transactions

Did you set up direct debits in the past for services or products you no longer need?

Cancel any subscriptions, memberships, products or services with the providers. Then ring your bank and block the transactions from being taken from your account. Make sure you cancel the service with the company first. You don’t want them sending debt collectors after you because your payments aren’t being processed.

Any savings you make, re-direct them to your savings account.

Related Posts:

- 3 Simple Ways to Stay Positive on a Tight Budget

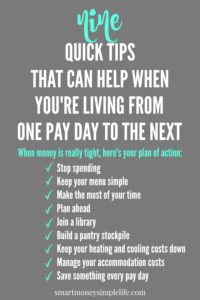

- When Money Is Tight – Tips for Living on Next to Nothing

- 5 Quick Tips to Eat Healthy plus Save Time and Money

- 10 Easy Ways to Save $1000 For Your Rainy Day Fund

- The Top 5 Ways to Spend Less Money

- Stop Impulse Spending with this Neat Trick

- How to Stay in Control of your Automatic Bill Payments

- Massive Money Saving Checklist

6. Save any windfalls

What are windfalls? Windfalls are the dollars that arrive unexpectedly.

Tax returns, inheritances, refunds on cancelled insurances, and yes, lottery wins.

When cash unexpectedly falls in our laps, it’s natural to want to spend it. The smart move is to save it. But, if you’ve been working hard and saving diligently, you probably to deserve to live a little.

In that case, save most of your windfall, enjoy a treat and live a bit. Not a blow the lot treat, but something you really enjoy that you’ve been denying yourself for a while.

And, save the rest.

7. Earn a little more

If your budget is already cut to the bone, it’s time to bring in more money.

This can be a huge challenge if you’ve been struggling with your finances for a while. You need energy and optimism to start side hustling and that can be in short supply.

You need to find a way to live life to the fullest, pay your bills and save a little money so you’re going to need to think outside the box. It’s not just about finding a second job.

- Can you get more hours at your current job?

- How about a pay rise?

- Do you have a hobby or skill you can turn into an income producing activity?

- Can you mow lawns or offer gardening services?

There are many ways to make extra money that can be short term immediate income, like mowing lawns or babysitting, or longer-term options like building a blog or online retail business.

The important things are that you manage to save a little money but still live a full and enjoyable life.

Are you ready to start your own blog? Use my simple, step-by-step guide to take you through the process of getting hosting and setting up your blog, including recommended resources to ensure your blog gets off to a great start and starts making money from day one. A special hosting discount is also included (only available through my link) which gives you a huge discount and, a FREE domain). I’ve earned $1000’s through my blog, and you can too.

Your Turn…

Are you living on a tight budget and still manage to save? How do you do it?

Share your tricks and tips for saving money with us, we’d love to hear from you…

Image: Pexels

This post includes affiliate links.