When money is tight, you need to be honest with yourself and then you need to get really creative.

Obviously, finding ways to increase your income are important, too but sometimes it’s just not possible to commit any extra time or energy to earning more money.

If that’s you, then, these simple tips might help you manage living on next to nothing.

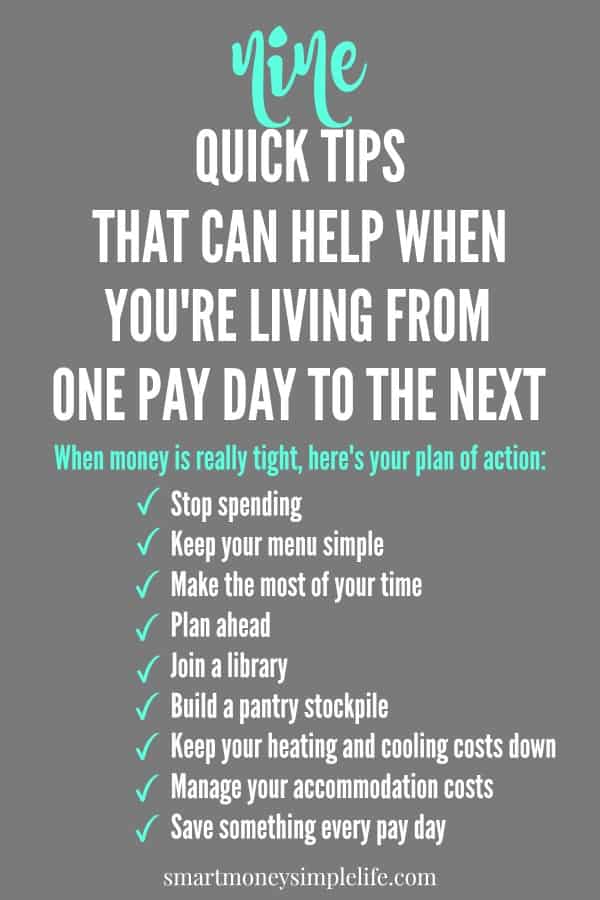

When things are really tight here’s a plan of action:

- Stop spending

- Keep it simple

- Make the most of your time

- Plan ahead

- Join a library

- Build a pantry stockpile

- Keep your heating and cooling costs down

- Manage your accommodation costs

- Save something every pay day.

*** This post contains affiliate links ***

When Money is Tight: Tips for Living on Next to Nothing

Table of Contents

Stop Spending

Apply the law of holes: if you find yourself in a hole, stop digging.

It’s the same with your budget. If you’re finding it hard to make ends meet, stop spending.

Ironically, when money is really tight, we’re often more likely to spend unnecessarily in order to feel better. It’s like eating cake though, spending on a treat feels good in the moment but then, inevitably, the guilt sets in.

You know you don’t need the, whatever it is, and you know you can’t afford it so you end up feeling worse than you did before buying your treat.

Don’t do it to yourself. Put the metaphorical fork down and step away from the table.

If you’re not sure where your money is going, start tracking your spending. Now. The best thing you can do is plug the money leaks as quickly as possible. You won’t regret your efforts here. I promise you.

How to Live on Half Your Income

Want more tips on living next to nothing? Read these articles:

- 3 Simple Ways to Stay Positive on a Tight Budget

- Smart Money Secrets from the Great Depression

- Stop Impulse Spending with this Neat Trick

- Massive Money Saving Checklist

Keep It Simple

When money is really tight and you need to provide food, clothing and entertainment to your family; keep it simple.

There’s no need to cook complicated meals. You can make lots of filling and nourishing meals from a simple selection of basic ingredients and you don’t need to spend a fortune.

For example, soups, stews or spaghetti sauce. All can be made with cheap cuts of meat, root vegetables like carrots and potatoes and canned tomatoes.

The secret ingredient for these dishes is time. If you can make them the day before, they’ll be rich and flavourful when you serve them to your family. They also freeze really well.

Speaking of freezing well, here are some tasty ideas for stocking your freezer with healthy, home-cooked meals.

Simple entertainment can also create meaningful family time. You can:

- Play board games

- Or, charades

- Take a ball to the park

- Go for a walk

- Tell stories around a camp fire (or candle).

You don’t need cable TV or even Netflix to relax and have fun.

50 Awesome Ways to Live Well on Less Money

Make the Most of Your Time

When you don’t have money available, you need to make the most of your time.

This can be a serious challenge if you’re working long hours and/or commuting long hours but the truth is, everything in life needs time, either your’s or someone else’s. If it’s someone else’s you’re going to need to pay for that time.

Think about that every time you pick up something that’s pre-prepared in any way; chopped, cooked or sliced. If money is really tight, you’ll need to forego the concept of convenience.

Cook from scratch with basic ingredients.

Leave the packets with separate individual serves on the shelf.

Plan Ahead

When times are tough, there’s a very real temptation to keep your eyes down and just concentrate on putting one foot in front of the other.

You can’t afford to do that.

You need to think about what’s ahead and plan for it.

Make sure you know when your bills are due and roughly how much they’ll be, then figure out how you’ll pay them.

If you’re getting by on a bare bones existence, most surprises aren’t happy ones. They’re usually unexpected bills. So, get a plan now and start working it as best you can.

The more aspects of your life you plan ahead of time, the less stressful life will be.

If you can remove some areas of uncertainty it will free up a lot of energy that would otherwise be burned up worrying about what might happen next.

Want more ideas on how to plan ahead? Read these articles:

- 13 Reasons Why You Need An Emergency Fund

- Five Savings Goals that will Change Your Life

- Single Parents: Smart Money Habits for a Simple, Happy Life

- 7 Simple Ways to be More Organised Every Day

- How to Change Your Life by Changing 6 Simple Habits

Join a Library

Libraries are a real treasure trove of adventure, knowledge and connection.

Most libraries provide services that go beyond loaning books to the community. They often have special reading events like story-time for children, information nights, author encounters, knitting circles… You’d be surprised.

Along with books, you can also borrow ebooks, DVDs, audiobooks and magazines.

Plus, most libraries also provide internet connected computers for members to use – free.

And, becoming a member of your local library is free! If you’re not already a member, go join. Now.

Build a Pantry Stockpile

Depending on how tight the money is, try to add some basics to your pantry when you can get them at a good price.

Look for good deals on bulk purchases and buy in bulk when you can.

Always compare the cost per unit, weight or volume of the bulk version to the usual size.

Sometimes, bigger isn’t necessarily better and you’re actually better off buying the standard size.

Also, consider whether you’ll be able to use it all before it reaches its use by or best before date. There’s no value in buying bulk if you end up throwing half the product away.

If you can’t start your stockpile immediately, try to put a couple of dollars to the side each payday to accumulate so you can buy sale items when you see them in the future.

Get all the details on how to Shop from Your Pantry.

Keep Your Heating and Cooling Costs Down

Keeping warm or cool can be a huge contributor to your general household costs.

Regardless of our financial situation, we should all be thinking about ways to keep our homes comfortable with minimal use of energy.

If you live in a very cold climate, make sure your windows and doors are sealed so the heat you’re paying your hard-earned dollars for isn’t escaping under the door. Make use of throw blankets if you’re sitting on the sofa. Put on a sweater and thick socks, don’t turn up the thermostat.

If you live in a hot climate, keep the blinds or curtains closed if it’s going to be a really hot day.

If you can, find ways to keep the direct sunlight off the windows.

The best option for being comfortable in the heat (within reason) is to stay away from air-conditioning. If you can avoid air-conditioning you will acclimatize to the temperature. Easier said than done with air-conditioning in nearly every modern workplace.

If you must use air-conditioning adjust the temperature up. The optimal temperature is between 70 – 75 degrees Fahrenheit or about 22 degrees Celsius.

Manage Your Accommodation Costs

Finding cheaper accommodation can be trickier than it sounds. You need to balance the costs involved in moving with the savings made paying less rent.

Depending on your circumstances, you might be able to rent out a spare room or go live in a truck in the parking lot where you work, like Brandon. But, there’s always the possibility that you can’t make any changes. If that’s the case. Let it go for the time being but plan ahead, you might be able to make a change when the lease is due for renewal.

If you’re paying a mortgage you might be able to renegotiate either the interest rate or the length of your mortgage in order to reduce your current payments. It’s worth exploring with your bank. The worst that can happen is they say, no.

Save Something Every Pay Day

When you’re living on next to nothing, saving is probably the last thing on your mind. But, the simple act of choosing to put a couple of dollars to the side as savings can make a huge impact on your mindset and your confidence. Sure, you might have to give up something in order to do it but you’ll find the rewards are priceless.

Commit to saving a couple of dollars, at the very least, every time you’re paid. Put it in a safe place and make a promise to yourself that you won’t use that money unless it’s an emergency. And, chocolate doesn’t count.

When Money is Tight

Having to count every penny is not fun. It’s stressful and can wreck your self-esteem if you let it.

Remember this though, it is a shame you find yourself in your current situation but you should never feel ashamed. Anyone can find themselves in the same financial position through a job loss, marriage breakdown or prolonged illness.

If you need help, ask for it. There are government agencies and many, many charities that can give you a helping hand so, don’t suffer in silence. Take it one day at a time and make the most of the time, skills and money you have, right now.

You can do it.

For even more money saving tips, check out our Massive Money Saving Checklist. You can even download it and print it for reference.

Remember to follow Smart Money, Simple Life on Pinterest and Facebook for lots more great information you can use to live your best life, starting today!

What are your tips for when the money is tight and you’re living on next to nothing?

Suggested Reading

Image: Pixabay